Our Mission

- We strive diligently to provide all of our clients and customers with professional services that enable transactions to be successfully completed in an ethical manner and to the satisfaction of all parties.

- Providing our buyers and sellers superior advice through leadership, experience, and knowledge.

- To develop a large customer base and provide them with ongoing support.

- To provide the best real estate and home ownership services possible while also making a positive contribution to the community in which we operate.

- Provide all stakeholders a satisfying experience while promoting accessibility and inclusion.

- Exercising ethical, loyal, and honest business behavior.

- Upholding a promise to continuously provide our resources and time to our communities.

Our Values

- We believe that home ownership and financial stability are integral to our success

- We believe in innovative approaches to the business

- We believe it’s important to offer the best possible customer service.

- We believe that access to excellent professional development opportunities should be made available to both our customers and workers.

- We believe in Excelling at what we do.

Our Vision

- The level of service provided to our customers is uncompromised due to our customer-centric approach, constant evaluation, and development of all we do.

- To provide excellent services and outcomes through creativity, initiative, leadership, and respect.

- To succeed in what we do, we do everything in our power to promote financial success for both our clients and staff. Those who have a dedication to working hard and supporting their communities are our favourite type of employees.

- Every step of the way in our journey, we want to serve and do good.

- We promise to always do the right thing for our clients and employees, resulting in success for all.

- We operate with a high level of accountability, taking full ownership in delivering on our commitment to excellence.

- We are resourceful, always seeking to discover a solution and providing options for any concerns that arise.

- We are just a phone call away, ALL YOU NEED.

OUR SOCIAL RESPONSIBILITY

- At Property Plateau, we have a defining culture of doing much more than just property sales and management.

- Our culture is to serve each other, our communities, and our planet.

- Our mission, vision, values, and culture differentiate us as industry innovators and leaders.

- Our purpose in life is to live happy, to be compassionate to those around us, and to make a difference in the community that we serve.

- We donate our time, talent, and profit to improve the community in which we operate, and our entire organisation will be involved as part of our responsibility.

- We strive diligently to provide all of our clients and customers with professional services that enable transactions to be successfully completed in an ethical manner and to the satisfaction of all parties.

- Providing our buyers and sellers superior advice through leadership, experience, and knowledge.

- To develop a large customer base and provide them with ongoing support.

- To provide the best real estate and home ownership services possible while also making a positive contribution to the community in which we operate.

- Provide all stakeholders a satisfying experience while promoting accessibility and inclusion.

- Exercising ethical, loyal, and honest business behavior.

- Upholding a promise to continuously provide our resources and time to our communities.

- The level of service provided to our customers is uncompromised due to our customer-centric approach, constant evaluation, and development of all we do.

- To provide excellent services and outcomes through creativity, initiative, leadership, and respect.

- To succeed in what we do, we do everything in our power to promote financial success for both our clients and staff. Those who have a dedication to working hard and supporting their communities are our favourite type of employees.

- Every step of the way in our journey, we want to serve and do good.

- We promise to always do the right thing for our clients and employees, resulting in success for all.

- We operate with a high level of accountability, taking full ownership in delivering on our commitment to excellence.

- We are resourceful, always seeking to discover a solution and providing options for any concerns that arise.

- We are just a phone call away, ALL YOU NEED.

- We believe that home ownership and financial stability are integral to our success

- We believe in innovative approaches to the business

- We believe it’s important to offer the best possible customer service.

- We believe that access to excellent professional development opportunities should be made available to both our customers and workers.

- We believe in Excelling at what we do.

- At Property Plateau, we have a defining culture of doing much more than just property sales and management.

- Our culture is to serve each other, our communities, and our planet.

- Our mission, vision, values, and culture differentiate us as industry innovators and leaders.

- Our purpose in life is to live happy, to be compassionate to those around us, and to make a difference in the community that we serve.

- We donate our time, talent, and profit to improve the community in which we operate, and our entire organisation will be involved as part of our responsibility.

Frequently Asked Questions

You can use this guide to familiarize yourself with rules, laws and other important information relating to your property.

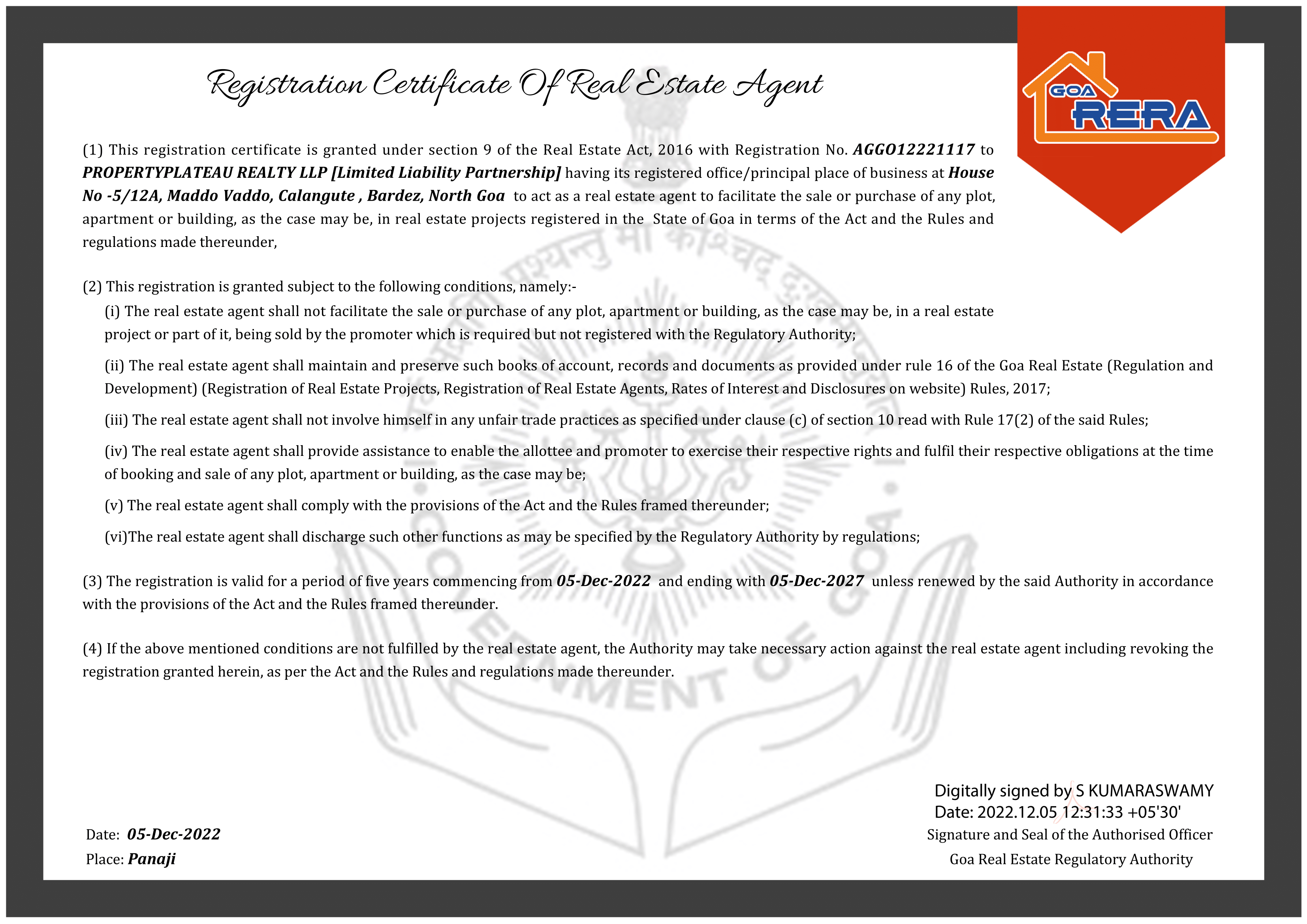

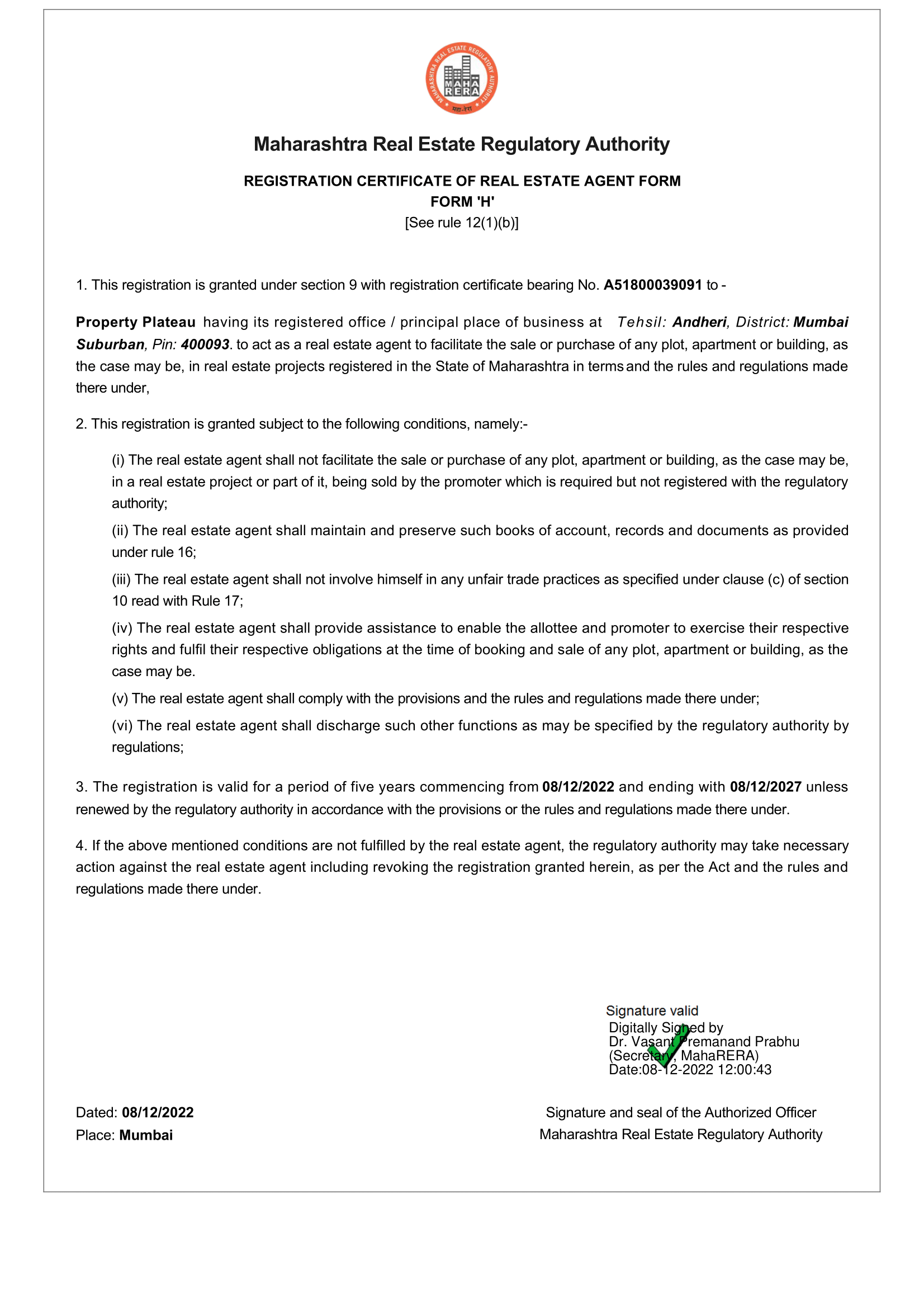

The Registration Act, 1908, the Transfer of Property Act, 1882 and the Real Estate (Regulation and Development) Act, 2016 mandates the registration of an agreement for sale of an immovable property. By registering the agreement for sale of an immovable property, it becomes a permanent public record. Further, a person is considered as the legal owner of an immovable property only after he gets such property registered in his name.

Carpet area is a term commonly used in real estate and property development, especially in India, to describe the actual usable floor area within an apartment or building. It refers to the space that can be covered by a carpet or rug and is typically calculated by measuring the inner walls of a room. Carpet area includes the space occupied by walls and excludes common areas like corridors, stairwells, lobbies, balconies, and shared spaces.

Property tax exemptions are essential for homeowners and businesses. These exemptions can vary by jurisdiction and purpose. In some areas, homeowners may qualify for property tax exemptions based on factors such as age, disability, or income level. Certain property uses, like agricultural or non-profit, can also lead to tax exemptions. Understanding these exemptions is crucial for property owners to manage their tax burdens effectively and make informed financial decisions.

Base Rate : It is the Standard lending rate of the bank , applicable to all retail loans, This rate subject to frequent changes on the basis of multiple inputs.

Mark Up : This component of a small percentage is added to the base rate to arrive at the EIR (Effective Interest Rates) for a specific type of a home loan and varies from one type to another.

Effective Interest Rate (EIR) = Base Rate + Markup

Rent Control Act , 1999 (Sec 55)

To regulate rental housing, the Maharashtra government passed the Maharashtra Rent Control Bill, 1999. Subsequently, the Maharashtra Rent Control Act, 1999, came into effect on March 31, 2000. The law aims ‘to unify and consolidate’ rental housing in the state and ‘for encouraging the construction of new houses by ensuring a fair return on investment by landlord’

Property Tax is an annual payment made to the local government to ensure the public infrastructure is taken care of.

Property Tax calculation employs a value based system for computing property tax. Property tax is a percentage of the Capital Value of the Unit . To Compute the tax , the civic body considers factors such as a Ward, Zone, locality, Property Usage, type of Occupancy, Carpet Area, Property Age, and Floor type.

- Locality i.e transport, schools, hospitals, market, business district, entertainment centres, hotels, restaurants, Pollution levels etc.

- Quoted area of the flat , i.e, Carpet Area, built up Area, and Super Built up area.

- Car Parking space

- Quality of Construction

- Reputation of the builder or seller

- Sufficient water and electric supply, other utilities

- Cost Components : Price, stamp duty, registration charges, transfer fees, monthly outgoings, society charges, cost of utilities.

- Potential for resale or renting out of the property

Home loans are long term loans and it’s important to figure out our overall interest liability towards the loan in the first place.

1 . EMI Calculator – you can calculate the interest amount applicable to your home loan by simply using Home Loan Calculator. You will be required to fill up the fields provided on the calculator with the followings details –

- Home loan amount

- Loan Repayment Tenure

- Rate of Interest

EMI Calculation Formula :

EMI = [P x r x (1+r)^n]/[(1+r)^n-1]

Wherein , P is Principal , R is rate of interest and N is number of instalments or loan tenure in Months

Landlords are entitled to make an increase of 4% per annum in the rent of the property that has been let out for any purpose. Rents can also be increased, if repairs or alterations have been made in the rented accommodation, to improve its condition. However, the hike in the latter scenario should not exceed 15 % Per annum of the expenses incurred on account of special additions

Request A Free Consultation

Our experts and developers would love to contribute their expertise and insights and help you today. Our experts and developers.

Get in touch with us

Awards and Accolades

Distinctions That Define Us

Clients Love

Testimonial

Property Plateau is a very professional property consultant where their representatives like Mr. Silvester are very proficient in showing the properties and have complete understanding of customer needs. My interaction with the company was a great experience when i purchased few offices at a prime location in Goa. I wish them all the best for their future endeavours. 👍